Umzug von Munich nach Lyon

Umzug von

Munich nach Lyon

Wie es funktioniert

Schnell und einfach Hilfe finden!

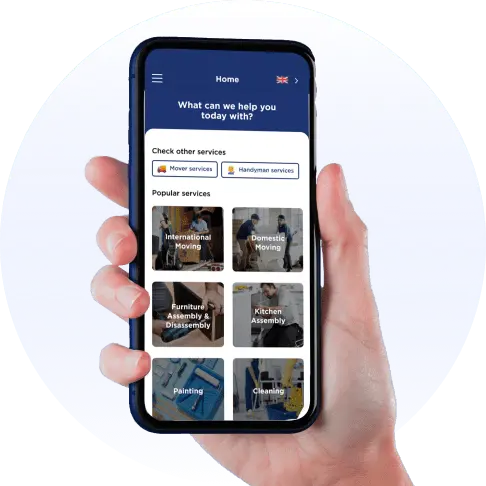

Moovick ist eine All-in-One-Plattform, die Kunden auf Wunsch professionelle Dienstleister für Umzüge und Renovierungsarbeiten in Echtzeit für ihre täglichen Bedürfnisse zur Verfügung stellt.

Auto

Van

3.5T LKW

7.5T (+) LKW

Auto (Taxi / Combi)

Perfekt für kleine Kartons, Flughafenabholungen und Gepäcktransport.

Transporter (7-17 m3)

Ideal für den Umzug von Studio- oder Einzimmerwohnungen mit einfachen Möbeln und Kartons.

3.5T LKW (20-24 m3)

Am besten geeignet für Wohnungen mit 1-2 Schlafzimmern, kleine Umzüge und Handelswaren.

7.5T (+) LKW

Am besten für 2 bis 3-Zimmer-Wohnungen und bis zu 10 Paletten in Standardgröße

Was man vor dem Umzug nach Lyon wissen sollte

Trotz der Tatsache, dass Munich einer der führenden Standorte für einen hohen Lebensstandard ist, entscheiden sich manche Menschen dafür, ihr Umfeld zu wechseln und neue Chancen zu suchen. Lyon ist eine hervorragende Alternative für deutsche Investoren, die ihre Aktivitäten in den Nachbarländern ausweiten möchten. Deshalb entscheiden sich deutsche Geschäftsleute für eine Umsiedlung nach Lyon.

Das Steuersystem, die hochqualifizierten Arbeitskräfte, die liberale Gesetzgebung und der Fokus auf die Bürgerrechte sind nur einige der Merkmale, die Lyon in groben Zügen ausmacht. Für Manche ist es eine Möglichkeit in Lyon zu bleiben und diese beantragen dann die Staatsbürgerschaft. Im Jahr 2018 gab es 6,5 Millionen Einwanderer. Das macht 9,7 % der französischen Bevölkerung aus. 4,1 Millionen waren nicht-Staatsbürger und 2,4 Millionen haben die französische Staatsbürgerschaft erworben.

Wenn Sie einen Umzug von Munich nach Lyon in Betracht ziehen, sollten Sie wissen, dass das Verfahren sehr einfach ist, da Munich und Lyon Mitglieder der Europäischen Union sind. Das bedeutet, dass Sie kein Touristenvisum, keine Aufenthaltsgenehmigung und kein Visum für einen kurzen oder langen Aufenthalt benötigen, um von Munich nach Lyon umzuziehen.

Also, auf was achten beim Umzug von Munich nach Lyon?

Es gibt keine allgemeingültige Antwort auf die Frage, welches Land die bessere Lebensqualität bietet. Die Lebensstile und die Ansichten darüber, was als gut oder schlecht gilt, sind sehr unterschiedlich. Die Menschen in Munich sind den Amerikanern insofern ähnlich, dass sie viel Geld verdienen, tolle Dinge kaufen und in luxuriösen Wohnungen leben wollen. Wo man arbeitet und wie viel Geld man verdient, entscheidet oft über die soziale Position. Städte sind begehrte Wohnorte, weil sie sauber, geordnet und sicher sind.

Im Gegensatz dazu folgt Lyon dem "französischen Lebensstil", der die Spiritualität über den Kommerz stellt. Die Menschen legen wenig Wert darauf, ein hochwertiges Auto zu fahren oder Haus zu besitzen; sie verbringen ihre Zeit lieber im Freien mit ihren Freunden und diskutieren und debattieren über verschiedene Themen. Es ist nicht nötig, viel Geld auszugeben, denn die Nebenkosten und Mieten sind niedriger als in Munich und viele kulturelle Aktivitäten sind kostenlos. Die örtliche Infrastruktur ist zwar nicht so leistungsfähig wie in Munich, dafür aber weitaus preiswerter. Lyon hat einen höheren Anteil an Fußgängern. Anstelle von Hightech können Sie in Kultur und Geschichte eintauchen.

Obwohl Lyon und Munich aneinander grenzen, sind ihre Bräuche und Kulturen sehr unterschiedlich. Egal, ob Sie Lyon besuchen, dorthin auswandern oder einfach nur neugierig sind. Jetzt werden wir uns einige bemerkenswerte kulturelle Unterschiede zwischen Lyon und Munich ansehen.

- Pünktlichkeit ist eine wichtige und hoch geschätzte Eigenschaft des deutschen Weltbildes. Sie werden dafür gelobt, pünktlich und diszipliniert zu sein. Ganz gleich ob sie auf dem Weg zur Arbeit oder zu einem Termin sind. Die Franzosen hingegen kommen regelmäßig unpünktlich.

- In Lyon beträgt die Arbeitszeit 35 Stunden pro Woche, sie beginnt um 9.30 Uhr und endet um 17 oder 18 Uhr. In Munich dagegen beträgt die Arbeitszeit 40 Stunden, sie beginnt um 8 Uhr und endet um 16 Uhr.

- In Munich beginnt das Frühstück oft um 6.30 Uhr und endet um 7.30 Uhr. Mit gekochten Eiern, Gemüse, Schinken, Käse und Brot. Die Franzosen mögen etwas Süßes zum Frühstück, wie Baguette mit Butter und Marmelade oder ihr berühmtes Croissant mit Kaffee.

In Lyon sind die Restaurantpreise (19,20 %) und die Verbraucherpreise (einschließlich Miete) (5,70 %) höher als in Munich. Auch Lebensmittel sind in Lyon deutlich teurer. 500 Gramm Käse in Munich kostet 5,97 $, in Lyon 7,87 $. Französische Lebensmittel sind 44 % teurer als deutsche Lebensmittel. Nur Verkehrsmittel (14,5 % billiger) und Wohnungen (13,5 % billiger) sind in Lyon günstiger. Insgesamt ist das Leben in Lyon etwa 15 % teurer als in Munich. Die durchschnittlichen Lebenshaltungskosten in Lyon (1363 $) sind 3 % höher als in Munich (1325 $). Lyon liegt auf Platz 29 der teuersten Länder der Welt, während Munich auf Platz 30 liegt.

Lyon ist zweifelslos eines der schönsten Länder Europas. Von den felsigen Bergen der Alpen und Pyrenäen bis hin zu den weiten Sandstränden der Atlantikküste gibt es genug, um sich zu verlieben. Ganz zu schweigen von den zahlreichen historischen Städten, der faszinierenden Kultur und natürlich der köstlichen Küche. Es gibt einige Dinge, die vor einem Umzug nach Lyon erledigt werden müssen.

Eröffnen Sie ein französisches Bankkonto

In Lyon Geld zu besitzen, vereinfacht das Leben erheblich. Es ist auf jeden Fall billiger, als mit der Bankkarte Ihres Landes Geld abzuheben oder Rechnungen zu bezahlen. Ein französisches Konto ist für alles notwendig, vom Bezahlen der Rechnungen bis hin, eine Hypothek zu bekommen. Also setzen Sie diesen Punkt ganz oben auf Ihre To-Do-Liste. Um ein französisches Bankkonto einzurichten, benötigen Sie eine Bestätigung der Aufenthaltsgenehmigung sowie mehrere zusätzliche Papiere.

Gesundheitswesen

Um ein Visum für einen Langzeitaufenthalt zu erhalten, müssen Sie in der Regel nachweisen, dass Sie über einen angemessenen Krankenversicherungsschutz eines Unternehmens in Lyon, verfügen. Der Versicherungsschutz sollte sowohl die normalen medizinischen Untersuchungen als auch eine Notfallbehandlung für die Zeit, die Ihr Visums gültig ist, decken. Um sicherzustellen, dass Ihre Versicherung für Ihr Visum gültig ist, wenden Sie sich an Ihre französische Botschaft vor Ort oder einem Konsulat, um herauszufinden, was genau erforderlich ist.

Lebenshaltungskosten

Die Lebenshaltungskosten sind sehr unterschiedlich, je nachdem, wo Sie sich aufhalten. In Paris ist das Leben zum Beispiel teurer als an anderen Orten des Landes. Wo auch immer Sie hinreisen wollen, es gibt verschiedene Kosten zu berücksichtigen. Zum Beispiel

Wohnungsmiete, Haushaltsausgaben, Lebensmittelrechnungen, Sozialabgaben und so weiter.

Übertragung des Führerscheins

Je nachdem, wo Ihr Führerschein ausgestellt wurde, benötigen Sie möglicherweise eine internationale Genehmigung, um in Lyon zu fahren. Es kann aber auch sein, dass Ihr Führerschein in Lyon nur für eine begrenzte Zeit gültig ist. Die gute Nachricht ist, dass Personen mit einem außereuropäischen Führerschein, der von einer ausländischen Behörde ausgestellt wurde, während des ersten Jahres eines Langzeitvisums weiterhin legal in Lyon fahren können.

Abgabe der ersten Steuererklärung

Wenn Sie nach Lyon ziehen, werden Sie sofort steuerlich ansässig, das heißt, Sie müssen eine Steuererklärung abgeben. Jeder Einwohner Lyons ist gesetzlich verpflichtet, eine Steuererklärung abzugeben, unabhängig davon, ob er Steuern zu zahlen hat oder nicht.

Bekommen Sie eine französische Sozialversicherungsnummer

Französische Staatsbürger, die sich vorübergehend in Lyon aufhalten, sind gesetzlich verpflichtet, sich in das öffentliche französische Krankenversicherungssystem, die so genannte "L'Assurance Maladie", einzutragen. Um Mitglied zu werden, müssen Sie zunächst drei Monate in Lyon gelebt haben und dann eine Sozialversicherungsnummer beantragen.

Ein Umzug von Munich nach Lyon bedeutet mehr als nur die Wahl einer Immobilie in der Nähe Ihrer Lieblings-Pâtisserie. Das ist ein Vorteil. Es könnte aber schwierig sein hierher umzuziehen, vor allem, wenn Sie kein Französisch sprechen und auf dem Land leben möchten. Jedoch, aufgrund eines einfachen Einwanderungsverfahrens und einer umfangreichen Verkehrsinfrastruktur kann der Umzug, sei es alleine oder mit Familie, gelingen. Ob Sie sich für ein Leben in der geschäftigen Stadt der Lichter oder ein beschauliches Dorf an der Côte d'Azur, in diesem Buch erfahren Sie alles, was Sie über einen Umzug nach Lyon wissen müssen.

Wenn Sie als EU-Bürger nach Lyon umziehen, benötigen Sie keine Dokumente. Sie machen von Ihrem Recht auf Freizügigkeit in der EU Gebrauch. Die Mairie der Gemeinde, in der Sie wohnten, würde es jedoch bevorzugen, wenn Sie nach ein paar Tagen mit Ihren Pässen wiederkommen. Für die erste Jahreshälfte müssen Sie keine Einkünfte angeben und keine Steuern zahlen. Sie planen im Mai des dritten Jahres einen Termin mit dem Finanzamt, welches Ihnen die Zugangsdaten zur Verfügung stellt, damit Sie sich anmelden können.

Ihr Einkommen für das gesamte vergangene Jahr können Sie online angeben. Wenn Sie ein Haus kaufen, informiert der Notar die Steuerbehörden, die dann innerhalb weniger Wochen einen Gebührenbescheid für die "taxe fonciere" ausstellt. Diese ähnelt einer Grundsteuer.

Das Wichtigste ist, dass Sie so schnell wie möglich eine medizinische Versorgung erhalten. Für die ersten Monate, sind Sie über die Krankenkasse Ihres Heimatlandes versichert.

Nach Lyon auszuwandern mag eine einmalige Gelegenheit sein, doch in der Nation des Käses und des Weins zu leben, hat sowohl Vor- und Nachteile. Hier sind also einige davon.

Vorteile:

- Gute medizinische Versorgung

Generell haben alle Menschen in Lyon, unabhängig von ihrem Wohlstand, Zugang zu einer allgemeinen Gesundheitsversorgung. Dies umfasst alles von Arztbesuche bis hin zu Zahnbehandlungen und Medikamenten.

- Arbeitsplatzsicherheit

Wenn es einen Vorteil gibt, in Lyon zu arbeiten, dann sind es die arbeitsrechtlichen Bestimmungen. Alle Mitarbeiter arbeiten im Rahmen einer Vereinbarung, die ihre Rechte sichert. Im Allgemeinen gibt es zwei Arten von Verträgen: unbefristete Verträge und befristete Verträge. Ausserdem, es ist extrem schwierig entlassen zu werden, solange das Unternehmen besteht.

- Nachhaltigkeit

Laut Statistik gehört Lyon zu den ökologischsten Ländern der Erde und wird als "eines der grünsten Länder" eingestuft. Dies könnte auf die Bemühungen des Landes, Wasserverschmutzung zu verhindern, zurückzuführen sein.

- Kultur

Genießen Sie die hervorragende Küche und den Wein, während Sie Lyons spektakuläre Gebäude, Monumente und Sehenswürdigkeiten besichtigen. Z.B. Die Louvre, die Kathedrale Notre-Dame und natürlich den Eiffelturm. Es gibt eine breite Palette von Aktivitäten, wobei jede Stadt oder jedes Dorf etwas Einzigartiges zu bieten hat.

Nachteile:

- Erneuerung des Visums

Dieses Problem hängt mit der oben erwähnten französischen Bürokratie zusammen. Weil sie so arg ist, braucht sie ein eigenes Gebiet. Eine der schwierigsten Aufgaben, die Sie als Auswanderer in Lyon zu bewältigen haben, ist die Erneuerung Ihres Visums.

Jedes Mal, wenn Sie Ihr Visum verlängern, haben Sie 3-6 Monate lang kein Visum und können in dieser Zeit das Land nicht verlassen.

- Hohe Steuern

In Lyon gibt es eine Vielzahl von Steuern. Derzeit beträgt die Körperschaftssteuer in Lyon 46 %. Das ist jedoch nicht die einzige Steuer beim Umzug nach Lyon. In Lyon werden durch die Steuern Dinge wie Krankenversicherung, Arbeitslosigkeit, Bildung und Verkehr bezahlt. Umzug nach Lyon hat sowohl Vor- als auch Nachteile.

- Stellenmarkt

Wenn sich Unternehmen in Europa ansiedeln wollen, steht Lyon häufig als letzte auf der Liste. Dies hängt natürlich mit den Steuern zusammen. Um Sie als Arbeitnehmer einzustellen, muss Ihr Unternehmen eine Steuer zahlen, die so genannten charges patronales (Arbeitgeberbeiträge). Dieser Prozentsatz kann zwischen 25 und 45 % Ihres Gesamtgehalts liegen.

- Alte Häuser

Die meisten Wohnungen und Wohnhäuser in Lyon sind ziemlich alt. Sie sind zwar attraktiv, aber nicht ausreichend isoliert, haben kleine Zimmer und nur ein Badezimmer. Es ist ungewöhnlich, Wohnungen oder Häuser zu sehen, in denen Beleuchtungskörper oder Küchen fehlen. Dennoch gibt es einige, die moderne Möbel anbieten. Diese sind aber schwer zu finden und viel teurer.

Deutsche und Franzosen legen großen Wert auf Solidarität, welche von US-Politikern nur selten angesprochen wird. Dieser Gedanke liegt sowohl dem deutschen System der gesetzlichen Krankenversicherung als auch der französischen Sozialversicherung zugrunde. Beides, Pfeiler einer sozialen Demokratie, die Gleichheit ebenso schätzt wie persönliche Freiheit. Ausgaben erheben sowohl Lyon als auch Munich zweckgebundene Gesundheitsabgaben und drängen die Verbraucher zum Kauf von "Zusatzleistungen" in privaten Krankenversicherungen. Der Patient hat die Möglichkeit, sich entweder in einem öffentlichen oder privaten Krankenhaus behandeln zu lassen, wobei die Behandlung aus Steuermitteln, aus privaten Mitteln oder aus einer Kombination von beidem finanziert wird.

Auf der Grundlage der von der Weltgesundheitsorganisation erstellten Klassifizierung der Leistungen von Gesundheitsdienstleistern, gehört Lyon zu den weltweit führenden Ländern. Lyon hat eine hervorragende Gesundheitsversorgung, von der Prävention bis zur sofortigen Operation.

Neben der ausgezeichneten öffentlichen Gesundheitsversorgung zahlen die meisten französischen Bürger eine zusätzliche französische Krankenversicherung. Eine "mutuelle" soll höhere Ausgaben für Gesundheit und Medizin abfedern. Arztbesuche sind eine dieser zusätzliche medizinische Kosten. Der Staat zahlt nur 70 %, die restlichen 30 % muss der Patient selbst tragen.

Wenn Sie kein Staatsbürger sind, benötigen Sie ein Arbeitsvisum, um in Lyon zu arbeiten. Wenn Sie nach Lyon reisen, insbesondere zum Arbeiten, und Ihr Unternehmen Sie unterstützt, brauchen Sie sich keine Sorgen zu machen. Wenn Sie jedoch in Lyon arbeiten wollen, nachdem Sie eingewandert sind, benötigen Sie eine französische Arbeitserlaubnis. Es ist nicht schwierig, ein Visum zu beantragen, wenn Sie eine Arbeit finden können. Diese sind für ein Jahr gültig und lassen sich einfach verlängern. Sie müssen nur in gutem Ansehen stehen bei den Behörden. Und lassen Sie sich von Ihrem neuen Arbeitgeber verbürgen.

- Körperschaftssteuersätze

Lyon hat einen höheren effektiven Körperschaftssteuersatz als Munich. Munich erhebt eine Unternehmenssteuer von 15 %, die zuzüglich eines Solidaritätszuschlags von 5,5 % und einer dezentralisierten Steuer von 13,64 % betrifft. Der französische Körperschaftssteuersatz beträgt 33,33%, mit einer Solidaritätsabgabe von 3,3 % für Großunternehmen.

- Verlustausgleich

Der grundlegende Unterschied zwischen der Nutzung von steuerlichen Verlusten in Lyon und Munich liegt in den Verfallsvorschriften, die in Lyon auf einer Änderung der Tätigkeit und nicht auf einer Änderung der Eigentumsverhältnisse beruhen. Außerdem erlauben die deutschen Vorschriften einen einjährigen Verlustrücktrag mit einem Höchstbetrag von 511.500 €, während die französischen Vorschriften einen einjährigen Verlustrücktrag mit einem Höchstbetrag von 1 Million Euro zulassen.

- Gruppenbesteuerung

Die französische Gruppierungsmethode "Intégration fiscale" hat eine höhere Mindestbeteiligungsquote als das deutsche System, obwohl die französische Steuerkombination vorteilhafter ist.

Um einen vergleichbaren Nettolohn zu erhalten, kann das Bruttogehalt in Munich 10 bis 20 % höher sein als in Lyon. Die Summe der zu zahlenden Steuer hängt in beiden Ländern von der Höhe des Arbeitsentgelts ab. Dennoch hat der Familienstand eine große Auswirkung auf den Steuersatz. Im Allgemeinen sind die Einkommensteuerabzüge in Munich wesentlich höher als in Lyon. Dies hat zur Folge, dass ein Arbeitnehmer in Munich für den gleichen Bruttolohn ein wesentlich geringeres Nettoentgelt erhält als ein Arbeitnehmer in Lyon. Eine Stelle mit demselben Gesamteinkommen ist in Lyon für den Arbeitgeber also viel teurer als in Munich.

Jüngsten Daten zufolge ist Lyon heute einer der besten Standorte in Europa, um zu Leben. Laut einer aktuellen uSwitch-Studie ist das Land an der Spitze der Rangliste, während das Vereinigte Königreich auf dem letzten Platz liegt. Arbeitszeiten, Mehrwertsteuer, Urlaub, Gesundheit und Bildung, Ausgaben und das Wetter haben dazu beigetragen, dass die Franzosen den höchsten Lebensstandard in Europa haben - und die Briten den niedrigsten. Dem Bericht zufolge waren die Umstände im Vereinigten Königreich so gravierend, dass einer von zehn Menschen erwog nach Lyon, Italien oder Spanien zu ziehen. Das durchschnittliche Jahreseinkommen in Lyon liegt um 7.000 Pfund niedriger als das im Vereinigten Königreich. Doch die Franzosen scheinen mit ihrem Los zufrieden zu sein.

Personen im Ruhestand können ein Besuchsvisum beantragen. Um ein Besuchsvisum zu erhalten, müssen Sie nachweisen, dass Sie über genügend Geld für Ihren Unterhalt in Lyon und eine private Krankenversicherung verfügen. Außerdem müssen Sie eine Erklärung vorlegen, wo sie bezeugen, dass Sie während Ihres Aufenthalts in Lyon nicht gegen Bezahlung arbeiten werden. Im Allgemeinen ist es für Nordamerikaner nicht schwer, eine langfristigen Wohnsitz in Lyon zu bekommen und dort ihre Rentenjahre verbringen. Sie müssen jedoch einen Anwalt konsultieren, bevor Sie irgendwelche Vorbereitungen treffen. Es wird eine Menge an Dokumentation erforderlich sein. Zur Zeit erforderlich, ist:

- Ein unterschriebener Reisepass, der noch drei Monate nach dem letzten Tag des Aufenthalts gültig ist ein Passfoto, auf das Formular geklebt/geklammert ein gültiger Reisepass

- Einkommensnachweis ein unterschriebenes und leserlich ausgefülltes Bewerbungsformular

- Krankenversicherungsunterlagen

- Belege für die Unterbringung in Lyon

- Schreiben, in dem er sich verpflichtet, keine Arbeit in Lyon zu suchen

- Gegebenenfalls eine Heiratsurkunde

- Ein E-Ticket oder ein Buchungseintrag, der das Abreisedatum nach Lyon angibt.

- Ein Formular für langfristig Aufenthaltsberechtigte muss ausgefüllt, datiert, unterschrieben und notariell beglaubigt werden.

Ein Umzug nach Lyon bedeutet für einige nicht viel mehr, als ein paar Koffer zu packen und zu einer möblierten Wohnung auf dem Land zu fahren. Für viele andere Menschen ist es nicht so einfach. Es gibt verschiedene Lösungen für Personen, die mehr umfahren müssen, als in ihr Auto passt. Unachtsamkeit beim Bewegen von Möbeln, sowie das Fehlen geeigneter Schutzmaßnahmen, können zu beschädigten Produkten führen die repariert werden müssen. Das Cerfa-Formular 10070 muss vorgelegt werden. Dieses Formular enthält die Anmeldung zur zollfreien Einfuhr nach Lyon, von persönlichen Gegenständen, welche nicht aus der EU stammen. Sowie die Anmeldung von Waren, die nicht unter die Ausschlussklauseln fallen.

Für den Umzug von Möbeln nach Lyon gibt es zwei verschiedene Möglichkeiten. Sie können Ihre Möbel entweder mit dem Flugzeug oder mit der Fähre transportieren. Dies bringt Kosten mit sich. Aber, sie können auch mit dem Zug, einem Lieferwagen oder einem anderen Transportmittel für 300 € transportieren, ohne eine Zollanmeldung machen zu müssen.

Die allgemeinen Lebenshaltungskosten in Lyon sind ziemlich teuer und hängen von einer Reihe von Faktoren ab. U. a. davon, wo im Land Sie leben. Paris wird routinemäßig als eine der teuersten Städte der Welt anerkannt. Obwohl Paris eine beliebte Stadt ist, gibt es zahlreiche ebenso attraktive Orte in Lyon, die viel zu bieten haben und mit wesentlich geringeren Lebenshaltungskosten. Das Leben in Großstädten wird immer teurer sein als das Leben in ländlichen Gebieten.

Umzug von Haushaltswaren nach Lyon

Wenn Sie darüber nachdenken, wie Sie Ihren Hausrat und Ihre Besitztümer verlagern können, sollten Sie zunächst Folgendes bedenken. Einige Waren, wie Alkohol, Zigaretten und tierische Produkte, sind durch französische Normen eingeschränkt. Diese sollten Sie berücksichtigen, bevor Sie mit dem Packen beginnen, damit Sie auf jeden Fall wissen, was Sie bei einem Umzug nach Lyon mitnehmen müssen und was Sie besser zu Hause lassen. Wenn Sie sich für einen Umzug entscheiden, müssen Sie entscheiden, welche Dinge Sie nach Hause schicken wollen. Am besten ist es, mit einer detaillierten Liste der Gegenstände zu beginnen, die Sie transportieren möchten. Es ist ratsam, eine Schätzung von Gewicht und Größe Ihrer Sachen zu machen. Sie müssen auch entscheiden, ob Sie Ihre Sachen auf dem Luft-, See- oder Landweg transportieren wollen. Die Versicherung für den Transport Ihres Hausrats ist auch etwas, woran Sie denken sollten falls Ihr Besitz während des Transports beschädigt wird.

Ein Umzug in ein neues Land ist eine aufregende Erfahrung. Das sollten Sie wissen, bevor Sie ein Haus kaufen und in ein anderes Land ziehen. Um sicherzustellen, dass alles so reibungslos wie möglich abläuft, bekommen Sie einige Ratschläge, die Ihnen weiterhelfen können.

Das für Sie am besten geeignete Haus finden

Wo Sie in Lyon ein Haus kaufen, hängt von dem Lebensstil ab, den Sie suchen. Wintersportler und Abenteurer wünschen sich eine Immobilie in den französischen Alpen, vor allem mit Ski-in/Ski-out-Zugang. Wer Wärme sucht und das ganze Jahr über die Sonne genießen möchten, sollten ein Leben an der Côte d'Azur in Betracht ziehen. Paris und Nizza sind pulsierend und großstädtisch, aber Bordeaux und die Provence sind ruhig und von herrlichen Landschaften umgeben. Aber, es gibt es eine Menge zu bedenken wenn es um Kaufentscheidungen in Lyon geht: wo und wie man sucht, wie man die ideale Wohnung findet, die Besonderheiten des Landes-Kaufverfahren usw.

Anmeldung bei den französischen Behörden und Erhalt eines VISA

Je nach Ihrer Staatsangehörigkeit benötigen Sie ein französisches Visum für die Einreise nach Lyon oder eine Aufenthaltsgenehmigung für den Aufenthalt in Lyon für länger als drei Monate, oder sogar beides. Möglicherweise sind zusätzliche Voraussetzungen zu erfüllen, wenn Sie an eine Ausbildung in Lyon denken. Sie benötigen kein Visum, um nach Lyon umzuziehen, wenn Sie derzeit in der EU wohnen.

Um ein Visum für einen Langzeitaufenthalt zu erhalten, müssen Sie sich 3 Monate nach der Übersiedlung nach Lyon, beim Office Francais de l'Immigration et de l'Intégration (OFII) anmelden. Unter anderem, müssen Sie sich unabhängig von Ihrer Staatsangehörigkeit bei den französischen Behörden anmelden. Die Registrierung ist zeitaufwändig. Das Verfahren umfasst ein Vorstellungsgespräch und eine ärztliche Untersuchung, daher ist es am besten, so schnell wie möglich damit zu beginnen.

Eröffnung eines französischen Bankkontos

Der Erwerb einer französischen Kreditkarte erleichtert die Zahlungsabwicklung. Möglicherweise sind Sie sogar verpflichtet, ein Konto an einer französischen Bank zu eröffnen, um Ihre Miete zu bezahlen oder von Ihrem Arbeitgeber bezahlt zu werden. Sie benötigen einen Personalausweis und einen Reisepass. Sowie eine Bestätigung Ihres Wohnsitzes in Lyon, z. B. einen Mietvertrag, und, falls Sie einen haben, eine Aufenthaltsgenehmigung.

Einige Banken erlauben Ihnen, vor Ihrem Umzug eine französische Debitkarte zu beantragen. Erkundigen Sie sich jedoch unbedingt darüber mit Personen, die nach Lyon ausgewandert sind. Ihr französisches Bankkonto kann an einem Tag eröffnet werden, und Ihre Bankkarte und Ihr Scheckheft werden innerhalb von 10 Werktagen eintreffen.

Steuern zahlen

Wenn Sie beabsichtigen, weit mehr als 182 Tage im Jahr in Lyon zu leben und zu arbeiten, gelten Sie als Steuerzahler, sobald Sie ins Land kommen. Wenn Sie nach Lyon umziehen und französischer Einwohner werden, müssen Sie bis zum 31. Mai oder dem Monat, in dem Sie umziehen, Steuern zahlen.

Sie haben bis Juni Zeit, wenn Sie Ihre Steuererklärung online einreichen. Für die Zahlung von Sozialleistungen, müssen Sie sich auch beim Finanzamt oder der Mairie anmelden. Wenn Sie Ihre Steuern nicht pünktlich zahlen, können Sie bestraft werden, mit bis zu 10 % des geschuldeten Gesamtbetrags.

Krankenversicherung

In Lyon ist eine Krankenversicherung vorgeschrieben. Wenn Sie nach Lyon umziehen, sind Sie gesetzlich verpflichtet, sich versichern zu lassen.

Nur auf diese Weise haben Sie Zugang zum französischen Gesundheitsdienst. Die meisten Menschen, die nach Lyon kommen, werden Anspruch auf die offizielle französische Krankenversicherung (sécurité sociale) haben. Da die französische Krankenversicherung nicht alle Versicherungsleistungen zu 100 % übernimmt, entscheiden sich viele Menschen für eine Zusatzversicherung, um besser versichert zu sein. Wenn Sie keinen Anspruch auf eine gesetzliche Krankenversicherung haben, müssen Sie eine private Krankenversicherung benutzen. Melden Sie sich auch so schnell wie möglich bei einem regionalen Zahnarzt und einem Arzt an.

Autofahren in Lyon

Um in Lyon ein Auto zu fahren, müssen Sie einen gültigen Führerschein aus einem EU- oder EWR-Land besitzen. Falls Sie einen nicht-europäischen Führerschein besitzen, können in Lyon bis zu einem Jahr mit einem internationalen Führerschein oder einem ins Französisch übersetzten lokalen Führerschein fahren. Es gibt einige allgemeine Richtlinien für das Fahren in Lyon:

- Beachten Sie die Geschwindigkeitsbegrenzungen: 130 km/h auf Autobahnen, 50 km/h in Städten. Auf anderen Strecken gilt ein Tempolimit von 90 km/h.

- Alle Kinder unter zehn Jahren müssen in speziellen Sitzen fahren.

- Wenn Sie in Lyon Auto fahren, müssen Sie Ihren Führerschein, Ihren Reisepass und Ihre Versicherungsunterlagen dabei haben.

- In Lyon müssen Sie auf der rechten Seite der Straße fahren.

Das Verfahren für die Zulassung eines ausländischen Fahrzeugs mit französischen Kennzeichen wurde vor kurzem geändert. Diese erhalten sie nur noch online, über ein Konto auf der ANTS-Website. Sie müssen sich über FranceConnect identifizieren. Hier haben Sie Zugang zu vielen offiziellen staatlichen Websites, wie z. B. bei lokalen Behörden oder Gesundheitszentren, ohne dass Sie sich mit getrennten Passwörter einloggen müssen. Die meisten der benötigten Informationen finden Sie in der aktuellen Zulassung des Fahrzeugspapiere.

Dazu gehören das Kennzeichen, das Kaufdatum, das Datum der aktuellen Zulassungsbescheinigung und das Datum der Erstzulassung. Sowie eine 11-stellige Nummer, die so genannte Numéro de formule du certificat d'immatriculation. Geben Sie die Marke und das Modell des Fahrzeugs, sowie die Fahrzeug-Identifikationsnummer und Farbe ein. Ausserdem, ob es sich um einen Neu- oder Gebrauchtwagen handelt.

Lyon ist ein trendiges, erstklassiges Land mit allen nur denkbaren Annehmlichkeiten und Infrastrukturen. In Lyon haben Sie Hochgeschwindigkeitszügen, die Sie mit allen Regionen Europas verbinden. WiFi in den meisten lokalen Cafés und genügend Kultur, um Ihren Hunger zu stillen. Foreign Living, steht Ihnen zur Seite. Die Franzosen haben fünf Wochen bezahlten Urlaub pro Jahr, arbeiten weniger Stunden pro Woche und haben das beste Gesundheitssystem der Welt, laut der Weltgesundheitsorganisation. Auch Sie könnten dem Rattenrennen entfliehen und nach Lyon umziehen. Diese Veränderung könnte auch dazu beitragen, dass Sie länger leben. Die Franzosen leben im Durchschnitt länger und gesünder als die Amerikaner. Von einigen, wird dieses auf ihr geringeres Stressniveau zurückgeführt.

| 💰Min gleitender Preis - 929 EUR | 🛠Zusätzliche Dienstleistungen - Reinigung, Handwerker, (De-) Montage von Möbeln |

| 💰Max gleitender Preis - 2270 EUR | 📲App - für Android, IOS |

| 🚚Andere Umzüge - aus Polen, Lettland, Schweden, etc. | 💳Zahlungssysteme - Debit- und Kreditkarten, Online Banking Sofort, Ideal, Bargeld |